China Relaxes Foreign Investment Policies, Signaling New Opportunities

What's up?

China has announced a more welcoming approach to foreign investments, indicating a shift in its international business policies.

What does it mean generally?

The relationship between China and the US has been fraught with challenges like trade barriers and differing defense policies in recent years. Despite these issues, there seems to be a new phase of cooperation on the horizon. Following a meeting between the US and Chinese leaders in November 2023, China is taking steps to open its market to foreign companies. This move could rejuvenate foreign business interests in China, potentially invigorating the country's economy.

What does it mean to me?

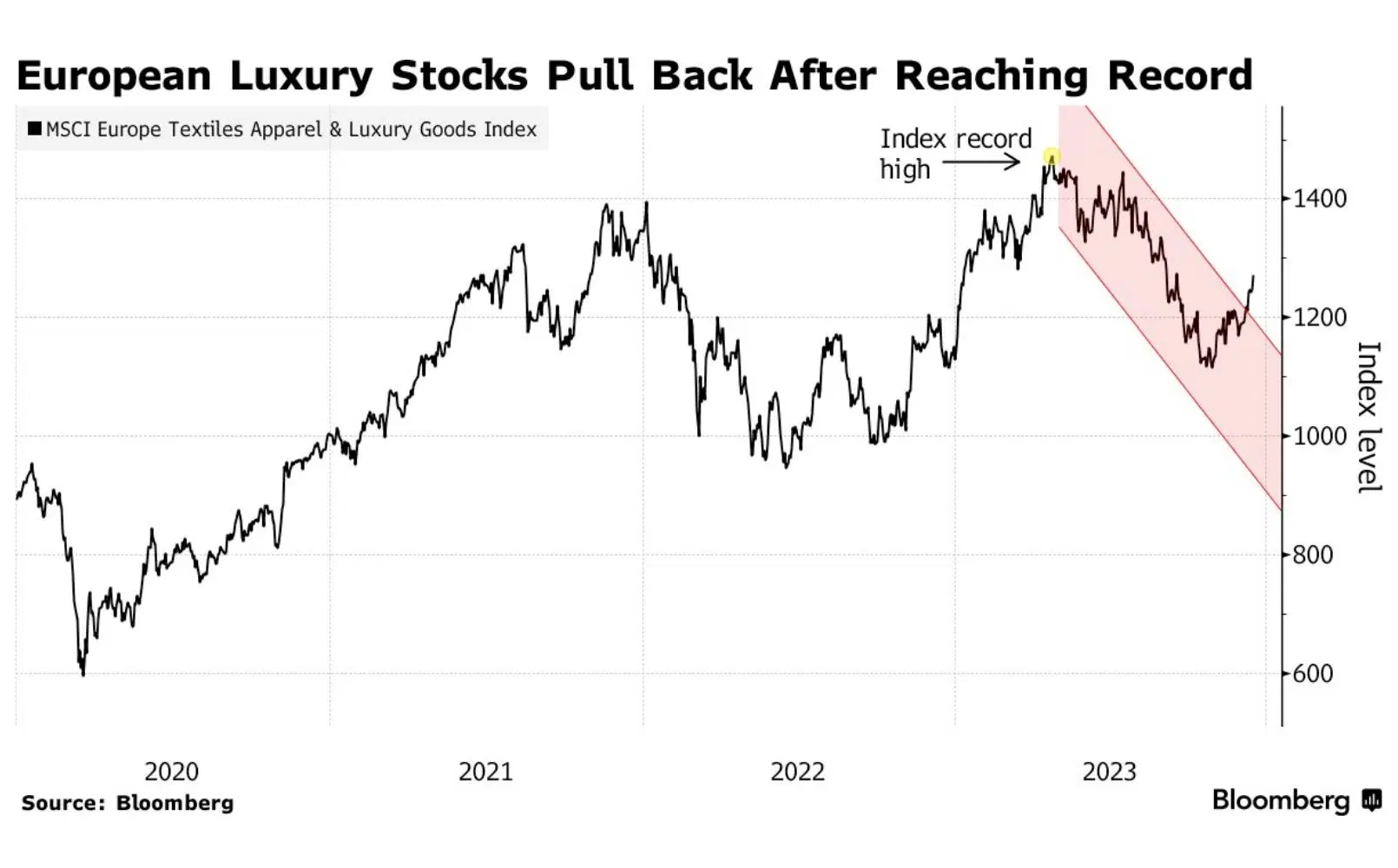

First of all, for markets this development signifies an imminent shift in luxury spending.

China, a key market for European and American luxury brands, is experiencing changes in consumer spending. With the general population becoming more budget-conscious, luxury brands have felt the impact on their sales and stock values. China's new policies could lead to increased spending power for Chinese consumers, which would be beneficial for global companies.

Secondly, in broader terms, this development implies new opportunities in emerging markets.

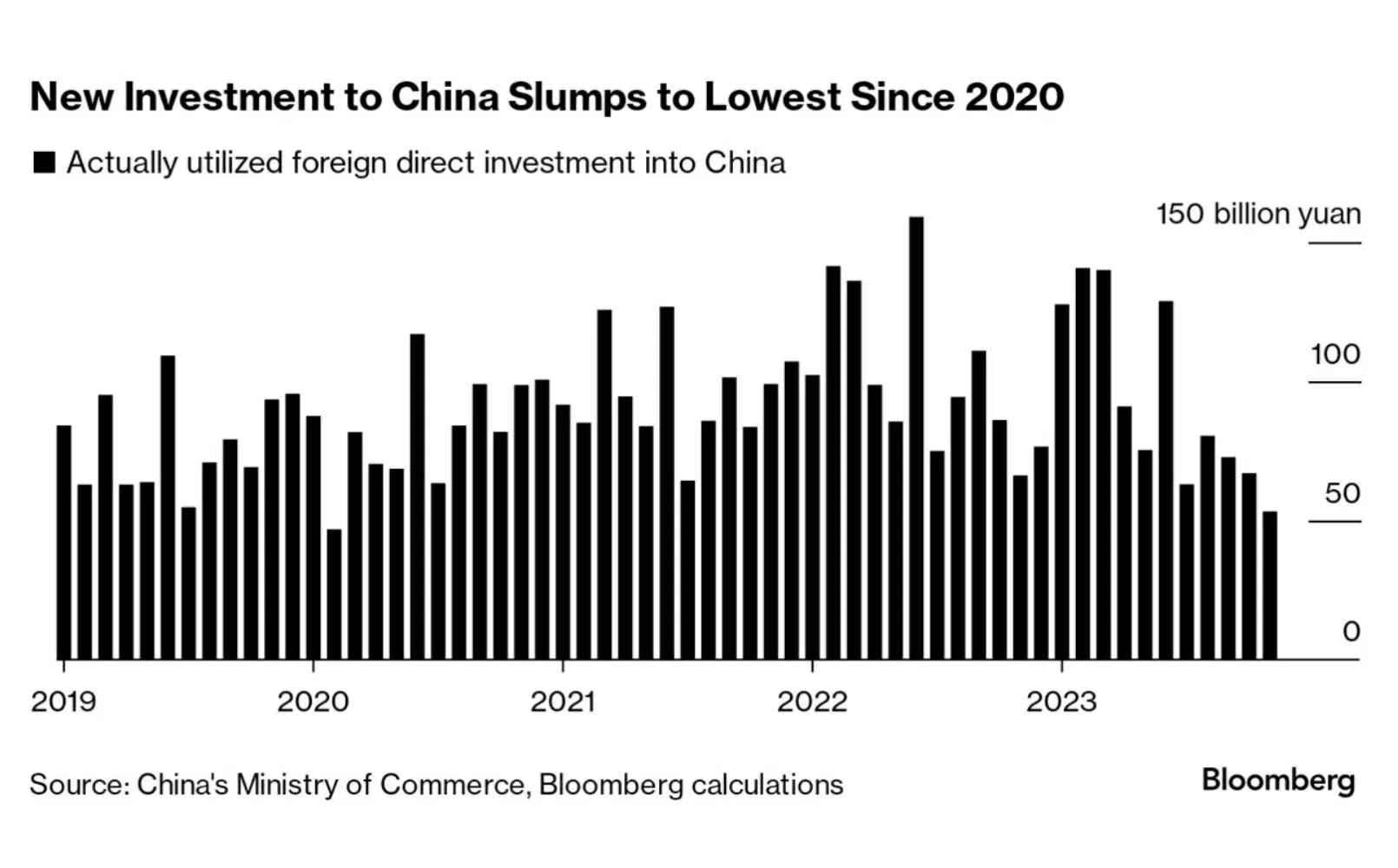

Last year, the US tech sector attracted a significant portion of investor attention, overshadowing emerging markets. With the volatility of US markets, investments in emerging markets, particularly in China, have become more attractive due to their relative affordability. China's economic improvements this year could encourage investors to diversify their portfolios with more affordable international options.